A positive sentiment on the cryptocurrency market is driving more people to buy bitcoin. The hodling rate for BTC has reached 9-month highs, with many traders optimistic that the price of Bitcoin will reach $70,000 by year’s end.

Bitcoin’s price has been on a rollercoaster ride this year, and the latest news is that it reached its highest point in 9 months. This could be a sign of a bull flag rally to $70K. Read more in detail here: bitcoin news.

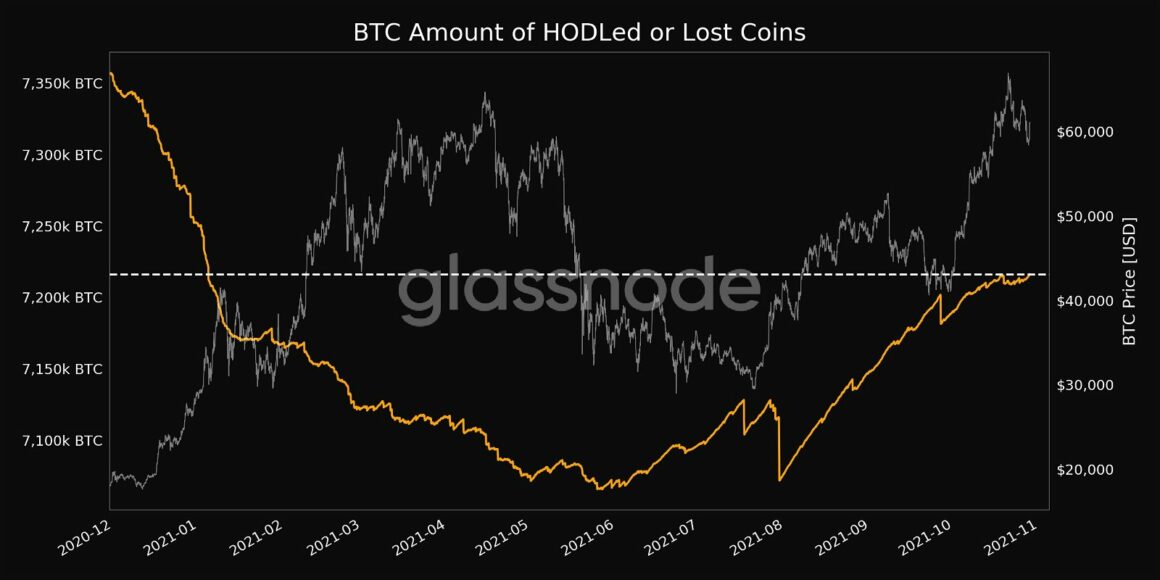

According to Glassnode statistics, a yearlong price surge in the Bitcoin (BTC) market has motivated traders to keep the token rather than exchanging it for other assets, indicating that traders are holding the token rather than trading it for other assets.

The overall quantity of “hodled or lost currencies” hit a nine-month high of nearly 7.21 million BTC on Oct. 28, according to the blockchain data analytics firm. In plain words, the Bitcoin statistic represented a rise in out-of-circulation tokens – those that had been held in cold wallets by long-term holders or lost due to human mistake and had little prospect of being recovered.

The total amount of HODLed or Lost Coins in BTC. Glassnode is the source of this information.

As a consequence, the total number of lost/hodled Bitcoins has surpassed 34% of the cryptocurrency’s entire supply of 21 million tokens, making it more rare.

There’s further proof of a Bitcoin supply shock.

Further data from CryptoQuant revealed that on Oct. 28, 2021, the total amount of Bitcoin reserves held across all crypto exchanges fell to its lowest level since August 2018 – 2.337 million BTC.

Meanwhile, since March 6, 2021, the Miners Position Index (MPI), which gauges the ratio of BTC leaving all miners’ wallets to its 1-year moving average, has been trading below zero, indicating considerable accumulation among miners.

All Bitcoin exchange reserves and miners’ positions are shown here. CryptoQuant is the source of this information.

All Bitcoin exchange reserves and miners’ positions are shown here. CryptoQuant is the source of this information.

“The quantity of Bitcoins [owned by miners] is equal to what it was in May when the price was around $40k,” a CryptoQuant analyst said as BTC tried to recover after plunging below $60,000 on Oct. 26, adding:

“It’s easy to see how far away we are from the last bulls run.”

What the technicals of the Bitcoin price suggest

After a 60 percent rise in October, Bitcoin’s price dropped from roughly $67,000 to $58,100. BTC/USD, on the other hand, established a purple parallel falling channel range, enhancing the possibility that the structure is a Bull Flag.

Bull Flag setup on the BTC/USD daily price chart. TradingView is the source of this information.

Bull Flag setup on the BTC/USD daily price chart. TradingView is the source of this information.

Bulls Flags are bullish continuation patterns that push the price back in the direction of its prior trend after a period of downward consolidation. Once the price breaks above the Flag’s upper trendline with bigger volumes, the technical indicator looks for upward targets at a length equivalent to the magnitude of the preceding upswing, also known as Flagpole.

Is Bitcoin’s price emulating the 2017 bull run? Eric Balchunas, an ETF specialist, explains on The Market Report.

The Bitcoin flagpole is around $15,000 in length. As a result, the cryptocurrency may theoretically soar by as much as $15,000 from the breakthrough point. The Fibonacci levels in the chart above might serve as support levels for a comeback to or above $70,000.

In the near term, however, not all traders believe the present scenario is positive.

“Some could call this a red flag, and that’s a possibility. But, IMO, the volume characteristics hint to a move down from here “Alex, a pseudonymous crypto trader, observed.

A breach below the recent lows of $58,000, according to fellow trader Pentoshi, would be terrible news for the bulls. He said, “

“BTC is now trading at 58,500 to the dollar. What if this is a large bull flag, and we’re in a bull market where bull flags are expected to break up? In principle, the price should not return to those lows, or Bitcoin will be in jeopardy. 64k to 29k, then back up to 64k, with just two macro mistakes throughout that period.”

The author’s thoughts and opinions are completely his or her own and do not necessarily represent those of Cointelegraph.com. Every investing and trading choice has risk, so do your homework before making a decision.

Bitcoin has been on a bull run since the beginning of the year, and its price has reached a 9-month high. The “bitcoin price calendar” is a tool that can help you find out when Bitcoin will reach certain milestones in the future.

Related Tags

- bitcoin price

- bitcoin price prediction

- why is btc down today

- bitcoin price cointelegraph

- ethereum price

Our Founder and Chief Enthusiast: With a background that’s a wild mix of tech enthusiasm, finance, and a short stint believing blockchain was a new martial arts technique, Matej is the heart and soul of TheBlockchainBrief.com. He’s got more passion for cryptocurrency than most people have for coffee, and that’s saying something.