Russia and China are the latest countries to join the gold rush, creating a new global gold market. This is in response to US sanctions on Iran, which has led to an increase in demand for physical bullion.

Russia and China have been buying gold at a rapid pace, and now they have formed an anti-dollar pact.

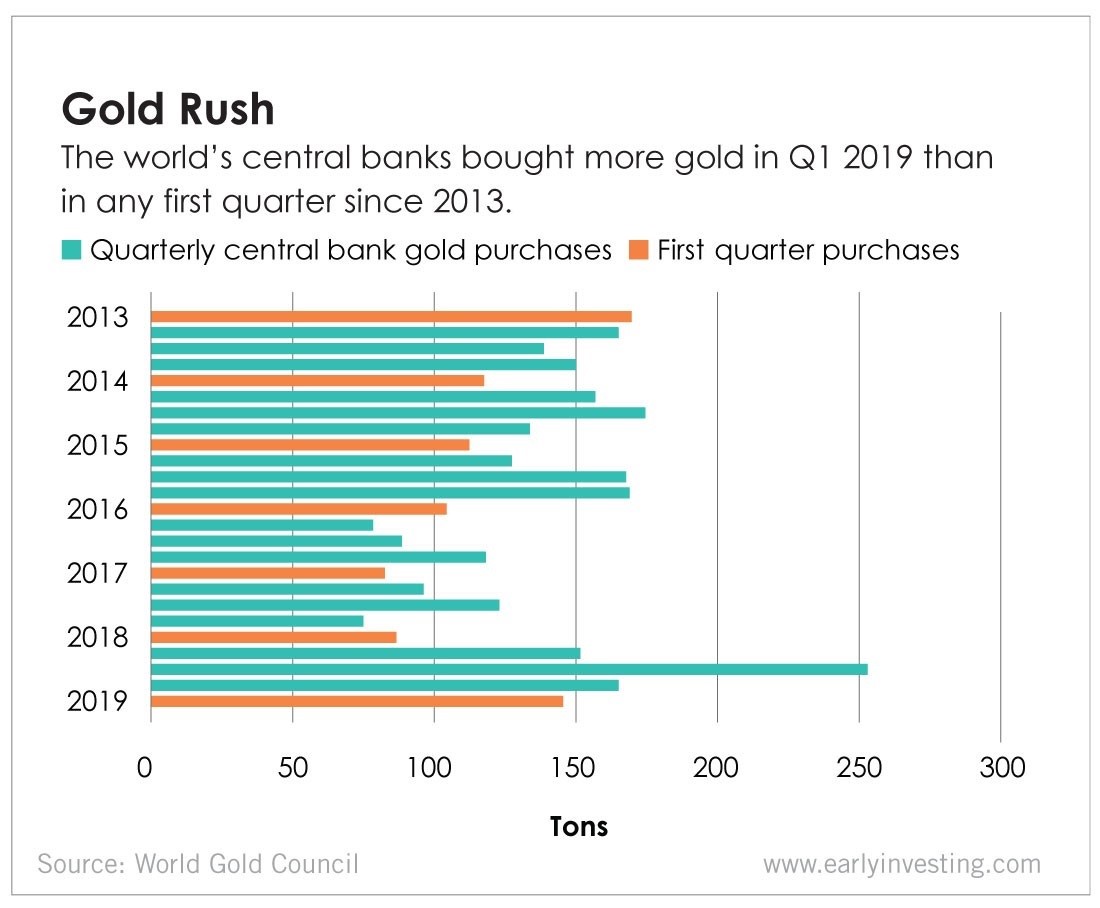

Gold is being hoarded by central banks. Central banks bought 145.5 tons of gold in the first quarter of 2019, according to the World Gold Council. This is a 68 percent gain over the previous year. It’s also the most amount of gold central banks have purchased in the first quarter since 2013.

Russia and China were the most active buyers, with Russia acquiring 55.3 tons and China 33 tons. Over the last four months, monthly purchases from the People’s Bank of China have averaged 11 tons.

Turkey (40 tons), Kazakhstan (11.2 tons), Qatar (9.4 tons), and India are among the other major customers (8.4 tons).

According to the World Gold Council, banks were encouraged to purchase gold in this quarter for the same reasons they were in 2018.

“Trade tensions, slow growth, and a low/negative interest rate environment have continued to weigh heavily on reserve managers’ thoughts. Geopolitics continues to be a source of concern. Central banks continued to acquire gold in the face of these difficulties, according to the Council.

These nations have made it plain that they want to decrease their reliance on the dollar. In reality, Russia has said explicitly that this is the case.

“No one currency should dominate the market,” Russian Prime Minister Dmitry Medvedev stated late last year. “This renders all of us reliant on the economic condition of the nation that produces this reserve currency, even when we are talking about a powerful economy like the United States.” “I’m going to say something that may raise a few eyebrows, but I believe some of these [US] sanctions are beneficial or constructive because they pushed us to do what we should have done ten years ago.”

Adam Sharp believes this is a signal that if the global fiat system collapses, Russia and other nations would revert to a gold standard.

“In particular, China and Russia. They’ll definitely attempt to replace the dollar with their own gold-backed currencies at some point,” Adam said.

Returning to the gold standard in a society where debt is out of control and money is printed in excess seems unlikely. But, as Adam points out, this isn’t due to the gold.

“Today, the gold standard seems absurd and unattainable, but that is because fiat is so out of control,” he said.

We aren’t the only ones who believe Fiat has gone completely off the tracks. Vice Chairman of Berkshire Hathaway, Charlie Munger, has issued a warning about uncontrolled money printing:

I’m terrified of a democracy believing that all issues can be solved by printing money. That, I’m sure, will eventually fail. You don’t have to increase taxes; all you have to do is print… Finally, if you print too much money, you’ll end up like Venezuela.

Munger went on to say that although the US situation isn’t as bad as Venezuela’s, he still has concerns.

Fiat money is on unstable footing, with government, corporate, and household debt all increasing — and no willingness to cope with the repercussions. It isn’t going to crash and burn straight soon. But, unless we alter our ways, it will happen at some time. As a result, investing in an alternative to the existing system is a no-brainer.

Gold has long been seen as a safe haven from fiat currency. However, we think that cryptocurrency is a much superior option. It offers a safe haven from the fiat system’s implosion. It’s programmable money with a limited supply. It’s getting better all the time. It’s designed for today’s world. And now, when it’s still early, is the best moment to invest.

The central banks buying gold 2021 is a topic that has been trending in the past few days. Russia and China have been leading the gold-buying spree, making an anti-dollar pact.

Related Tags

- countries buying gold

- russia and china buying gold

- countries buying gold 2021

- china buying gold 2020

- china buying gold 2021

Our Founder and Chief Enthusiast: With a background that’s a wild mix of tech enthusiasm, finance, and a short stint believing blockchain was a new martial arts technique, Matej is the heart and soul of TheBlockchainBrief.com. He’s got more passion for cryptocurrency than most people have for coffee, and that’s saying something.